Although big-name technology shares have been all the rage in the past months, it seems that the hype is nearing its end, and investors should take their profits while they can and divert their attention elsewhere, at least according to the investment banking giant Goldman Sachs (NYSE: GS).

As it happens, Alexandra Wilson-Elizondo, Goldman Sachs Asset Management’s co-chief investment officer of multi-asset solutions, has shared her company’s view that tech stocks will come under pressure, shifting its focus on areas like energy and Japanese stocks, per a report on April 10.

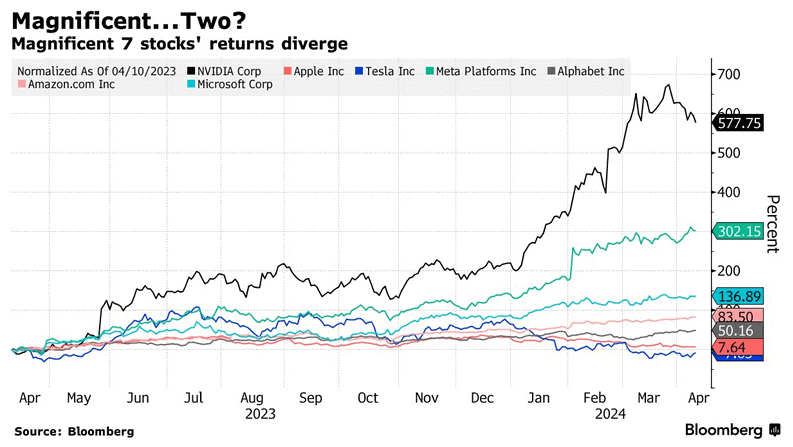

Magnificent 7 stocks divergence

Indeed, according to her, the problem with tech stocks is their risk-reward profile skewing downward, as evident in the divergence among the Magnificent 7 stocks, that have seen Tesla (NASDAQ: TSLA) drop 30% this year and Apple (NASDAQ: AAPL) struggling as well.

At the same time, Nvidia (NASDAQ: NVDA) has made a remarkable 76% surge year-to-date (YTD), leaving analysts to question whether the company has reached its peak, particularly as it faces the threat of diminishing dominance in the artificial intelligence (AI) sector.

Alternatives to tech stocks

As Wilson-Elizondo further highlighted her company’s practices regarding tech stocks:

“We like taking profits on technology and moving toward other sectors. (…) While we still believe in being long equities and having them in the portfolio, we think that there are some more attractive opportunities to access.”

Specifically, these other opportunities seem to lie in energy shares, which the expert pointed out serve as Goldman Sachs’ hedge against inflation and geopolitical risks, as well as Japan, due to the Asian country’s corporate reforms, stronger business sentiment, and relatively low valuations.

Ultimately, Goldman Sachs might prove correct in the long run, but it is important to remember that trends can shift and major finance organizations may not always be right in their predictions, so doing one’s own research before investing in any asset class is critical.

Kupujte sada dionice uz eToro – pouzdanu i naprednu investicijsku platformu

Odricanje: Sadržaj na ovoj stranici ne bi se trebao smatrati investicijskim savjetom. Ulaganje je špekulativno. Kada ulažete, vaš kapital je u opasnosti.

Source: https://finbold.com/goldman-sachs-sounds-alarm-dump-these-stocks-before-its-too-late/